Our Solutions

Comprehensive Financial Planning

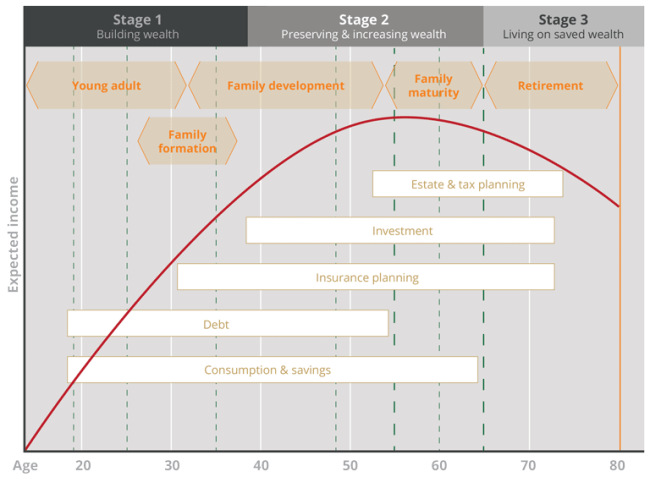

Our client relationships form the heart of our business. Through dedicated and continued interaction with our clients we have over time come to know them personally, and have grown to better understand their objectives, and requirements. We can identify where you as our client currently finds yourself in your financial life: Whether you are for example in the starting blocks or nearing retirement. Pentagon Financial Solutions PTA (Pty) Ltd endeavours to work with you, as our client, in order to better you to achieve your dreams and goals in every stage of your life.

An introduction to the solutions for your financial needs is made in the five life stages we have identified. It is however important to remember that each client is unique and it is, therefore, in your own interest to have a discussion with your financial planner, to enable him/her to conduct a proper analysis and make appropriate recommendations in order to address your specific needs.

We pride ourselves in our ability not to sell products, but rather to address financial planning needs on a holistic basis, allowing us to integrate all relevant information. This enables us to provide our clients with appropriate advice that best addresses their needs and aspirations. Generic financial planning frameworks need always to be adapted to account for not only changes in the client’s needs throughout his/her life, but also for changes to the economic environment. Pentagon Financial Solutions PTA (Pty) Ltd is therefore in the business of lifelong partnerships with our clients.

Leaving a Legacy

On or after retirement, one normally consolidates your assets and you want to explore what options you have in getting the most out of your life savings. In other words, you want your money to “work” for you. Although it is a time when many clients consider downsizing, the majority wants to maintain their standard of living, and their independence, and definitely follow through on that special dream that was always postponed, like a trip abroad or spending more time doing community work. It is also a time when clients consider the maintenance and ultimate distribution of their wealth for the security of their loved ones.

The main risk that needs to be addressed during this stage is the preservation of your estate.

Clients often misunderstand estate planning as only consisting of the drawing up of a last will and testament for the winding up of your estate upon your, and/or your spouse’s death. With the right planning, however, plans can be put in motion with proper estate planning methodologies to not only preserve, but also create wealth in your estate during your living years.

Although there are some uncertainties regarding the future of certain elements of the trust tax regime, National Treasury announced in the first half of 2013 that the proposed changes to tax legislation regarding trusts will not take place immediately. The proposed amendments aim to eradicate income splitting opportunities afforded through this principle, but should have no effect on special trusts, created for the care of children or family members that need special care and treatment.

At present, the conduit principle operating in trust tax law, allows for income that accrues in a trust to be taxed in the hands of the beneficiary.

Consider the following simplified example:

Assume that there are three beneficiaries of a trust, who are natural persons. In the 2013/ 2014 tax year the trust earns interest of R75,000.00 on its invested capital. If the trust retains the interest and pays tax on it, it gets no exemption and the tax liability at 40% is R30,000.00. Now assume that the trustees award the interest in equal proportion to the three beneficiaries. The tax liability of each beneficiary will be as follows: interest income R25, 000.00, of which R23, 800.00 is exempt (this would be R34, 500.00 for a beneficiary older than 65). The taxable balance is thus R1, 200.00 on which, even at the maximum marginal rate of 40%, the tax would be R480.00. The total tax payable on the interest would thus be R480 x 3 = R1, 440.00.

Pentagon Financial Solutions PTA (Pty) Ltd can assist the client in estate planning, the drawing up of a trust and give guidance in the choice regarding trustees.

Nearing retirement

Now is the time to reap the fruits of years of hard work.

The focus is shifting from the accumulation of wealth to the generation of income, as your needs will fundamentally change after retirement.

One of the major risks that need to be addressed in any retirement plan, concerns the reality of ever increasing life expectancies of our clients (longevity risk). Longevity risk or the risk of outliving one’s financial provision (savings) is from many perspectives not a simple matter to address. There are a wide range of factors which must be considered, for example:

Overall levels of wealth, whether you have reasonably accumulated enough to last for an extended lifetime.

Changes to spending patterns throughout the phases of retirement (active, passive, frail),

The cost associated with private sector medical products and services.

Behavioural biases for example the inability to make long term decisions.

Consider the following table on the income (p.a.) you may draw from your accumulated wealth:

| Age | 55 | 60 | 65 | 70 | 75 | 80 | 85 & older |

| Male | 5.50% | 6.20% | 7.30% | 8.70% | 10.70% | 13.50% | 17.50% |

| Female | 4.80% | 5.40% | 6.20% | 7.30% | 8.90% | 11.20% | 14.60% |

Statistics show that more than 75% of clients in South Africa realise at some stage that the amount of savings accumulated will not be enough to address their income needs. But even more important is the fact that many clients forget to consider the tax implications of their investment decisions. Tax can potentially erode your wealth and it is evident that tax concessions in South Africa will continue to favour the poor that are not investors.

Pentagon Financial Solutions PTA (Pty) Ltd can provide a client with advice and the appropriate product solutions. This may inter alia include the structuring of more than one investment vehicle to provide tax efficient income after retirement. Savings can be invested within a diversified portfolio, structured according to a client’s individual risk profile, to assure that sufficient income is generated to provide an adequate standard of living after retirement.

Achieving even more

Your family is maturing, and your focus is now on preserving and growing your wealth. For many individuals, their careers are peaking and the energy and many hours that they have devoted to their careers, is rewarded with success in terms of position, and probably the highest level of income during their productive lives. Your focus at this stage should therefore be to firstly preserve your capital, but also to grow it in a properly diversified portfolio, across asset classes, and with the best of breed asset managers that actively manage your portfolio on a daily basis.

A maturing family often implies adult dependants with very expensive needs, for example tertiary education and their own membership of a medical aid. Many clients may also during this phase sell their companies, or receive “golden handshakes”, well before their normal retirement age. As a result they may consider new job opportunities, or even decide to start a new business. They may even consider accessing their retirement savings, in order to fund their new business. One of the major risks that need to be addressed at such a juncture is the opportunity cost of withdrawals from your current retirement savings, and the likelihood that you may lose that capital in the event that your new business fails.

When making a withdrawal from your retirement savings, the first significant consequence is that this will invariably result in a tax liability. A withdrawal is considered a distribution from the plan. This means that the necessary taxes need to be paid on the amount distributed. At the moment the following table will apply:

| Taxable portion of withdrawal Rates of tax | |

|---|---|

R0 – R22 500 | 0% |

R22 501 – R600 000 | 18% of the amount over R22 500 |

R600 001 – R900 000 | R103 950 plus 27% of the amount over R600 000 |

Over R900 000 | R184 950 plus 36% of the amount over R900 000 |

It is important to note that you are only allowed one withdrawal from your retirement funds before the age of 55.

One of the biggest consequences of making a once-off withdrawal is rarely considered by clients: the lost opportunity of compounding interest earned over time. If the time value of money (the idea that a Rand today is worth more than a Rand in the future because of its potential earning power) is not applied, you could be missing out on thousands of Rand at retirement.

The financial consequences for taking a withdrawal from your retirement savings greatly affect your ability to meet retirement saving goals. The alarming fact is that many clients make once-off withdrawals every time they change employers. When multiple withdrawals are taken, the negative effects compound, creating bigger obstacles for you to overcome before you reach retirement.

Pentagon Financial Solutions PTA (Pty) Ltd can provide a client with advice and the appropriate product solutions, inclusive of a preservation fund to protect your accumulated wealth, and assisting in investing in a savings plan within a diversified portfolio, to provide for your maturing family.

Building a Family

As we start our adult lives, after school or studies, we form relationships that over time are normally celebrated in a joyous occasion when two young people are joined together in marriage. The young married couple invariably aspire to create a home for them and their family, although they may be somewhat cash strapped. The reality of life is that, from that moment onwards, most of their income will be applied to the funding of their lifestyle and for providing a proper education for their children.

While you or your spouse may or may not have some experience and knowledge of financial products and financial planning per se, Pentagon Financial Solutions PTA (Pty) Ltd can guide you through your family’s changing financial requirements and needs. In most cases, a proper financial plan for a family is sometimes based on, for example, the implications of the financial agreement (i.e. the Ante Nuptial Contract) between you and your spouse entered into before you got married. At all times, the most pertinent risks during any particular life phase, i.e. income protection during unforeseen illness or disability, or high debt levels, or provision for the education of your children, needs to be provided for in a cost effective but coherent manner, taking into account all aspects considered relevant for the continued well-being of your family. In this process, the reality of the eroding nature of inflation also needs to be considered.

We can, therefore, provide a client with advice and the appropriate product solutions inclusive of inter alia Income Protection for both spouses to guard against extended period of illness, Life Cover for both spouses to provide for your family once you pass away and assisting in investing savings within a diversified portfolio according to a client’s individual risk profile. We can assist you in the drawing up of your last will and testament, and give guidance in the nomination of guardians or trustees with the right profile, to ensure that your remaining children are well taken care off.

Independent in the starting blocks

You are independent with very few commitments. Your focus is on consumption, for example buying your first vehicle and going on holidays. You save very little and therefore your financial capital is either non-existent or low.

Do not forget that the most valuable asset you possess at the moment is your human capital. Human capital is an individual’s ability to generate future savings and wealth or in quantitative terms: the present value of a person’s future salary. It is increased through education and career decisions, and for most people it peaks early in their career and declines towards zero at retirement.

If you understand how precious this asset is, the need to convert it appropriately to wealth, i.e. the requirement to do financial planning, is clear.

The risks that need to be addressed during this phase could be the inability to repay debt, or unforeseen illness and/or disability that could prevent a person to continue to earn an income.

Pentagon Financial Solutions PTA (Pty) Ltd can provide a client with advice and the appropriate product solutions inclusive of inter alia medical aid and medical insurance and the structuring of an emergency fund for unexpected expenses. Income Protection to guard against extended periods of illness, or cover for temporary or permanent disability is of specific importance for young professionals at the start of their careers. Continuous advice and assistance in investing savings within a diversified portfolio, structured according to a client’s individual risk profile, within an appropriate time horizon, also forms part of our services.

Albert Einstein coined compound growth as “the eighth wonder of the world”.

Look at the following table as an example:

R300 with a contribution increase of 10% per year

| Term in years | Growth | Cumulative investment | Cumulative growth | Total value |

| 5 | 10% | R 21,978 | R 6,087 | R 28,065 |

| 10 | 12% | R 57,375 | R 43,855 | R 101,230 |

| 15 | 14% | R 114,381 | R 191,925 | R 306,306 |

| 25 | 16% | R 354,049 | R 1,947,003 | R 2,301,052 |

| 35 | 18% | R 975,688 | R 11,660,214 | R 12,635,902 |